Why choose Oceania Insurance?

Easy-Breezy Digital Insurance

Our digital chat and policy management makes insurance simpler, faster, and more efficient.

20+ Years of Aussie History Behind Us

We’re backed by Auto & General, who have walked the walk in Australia since 2000.

Find Answers 24/7

No matter what time of day, our online systems can support you through managing and renewing your policy, or making a claim.

Car Insurance Made for Aussies

Car Insurance Made for Aussies

Find Out More

Everything up above is just a summary of what you can expect from Oceania Car Insurance. For all the little details (including the terms, conditions, limits and exclusions that apply), check out the Product Disclosure Statement (PDS).

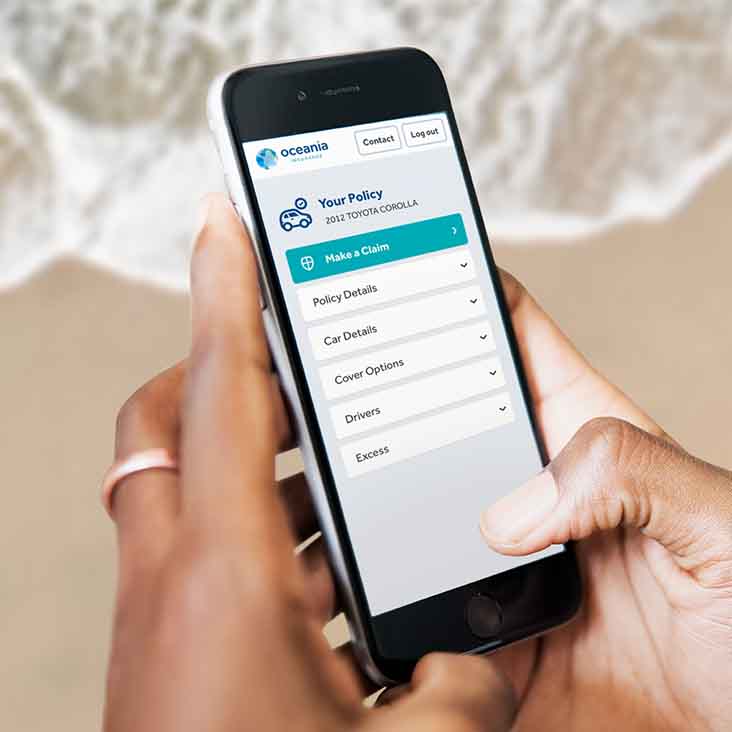

Managing Your Car Insurance Online

No matter whether you need to edit your policy, make a claim, change your payment details or simply update some details, our online Policy Manager makes it a piece of cake.

Car Insurance FAQs

It’s actually easier than you might think to make a claim. Most claims can be made without any fuss through our online Policy Manager. We’ll ask you a handful of questions just to work out what happened. We’ll even give you a chance to pay your excess early, to help make the process simple and smooth.

Whether it’s receipt of payment of your excess or us receiving your claim, we’ll send you SMS messages to confirm each step – just so you know it’s been received on our end.

All this means is we’ve turned to digital chat systems using our website, iMessage, WhatsApp, emails, texts, and others as our key ways to communicate. This does away with the old hassles, like listening to music on hold and waiting in long phone queues.

Our friendly team of experts will be on hand to help however we can, from guiding you through changing your policy using your online Policy Manager, to renewing your policy, and making claims. And due to us using digital chat (and not the less efficient methods of the past), we pass those savings onto you.

It really is a win-win for everyone!

We’re backed by Auto & General, who are one of Australia’s biggest car insurers. As of right now, over one million Aussies are being insured in the Auto & General network. So you can trust that you’ve got the backing, support, and systems from one of the best in the business.

What makes Oceania different is we’re the new generation. We rely on digital support and systems and make insurance more efficient in the process. Really, we just want to make things simpler, smarter, and savvier for Aussies.

View more FAQs, or contact us directly for more information.